What is Merchant Account Load Balancing?

Load balancing a merchant account allows for the dynamic division of transactions across multiple merchant accounts. With load balancing, a high volume merchant can manage several merchant accounts on a single dashboard. This ensures easy management of accounts, helps to minimize risk and boost processing volumes.

Load balancing gives you the peace of mind knowing that if you meet any challenges related to your merchant account along the way, it would not be catastrophic for your business. If your account with one processor is frozen, you will still have another account to manage your transactions. Further the parameters can be pre-set to meet both processing limits and ticket sizes, ultimately keeping you out of trouble with your credit card merchant processor.

Load Balancing Your Merchant Account – Keeping You Out Of Trouble

If you own a restaurant or retail store, one credit card processor is all you need. Unfortunately, if you run an high volume business or offer high ticket items, merchant account load balancing can come a great asset for your business, especially if you have multiple high risk merchant accounts with various monthly processing caps. This technology would allow you to run multiple merchant accounts with automated processing parameters.

Relying on one bank for your high risk credit card processing needs is, in itself, a big risk. The underwriting guidelines set forth on your account include volume caps and ticket size caps. Processing outside of your merchant agreement can cause financial holds and possible termination of your account. that govern financial institutions change. Also banks merge or get acquired. And under any of these conditions, a bank could decide to opt out of a merchant agreement.

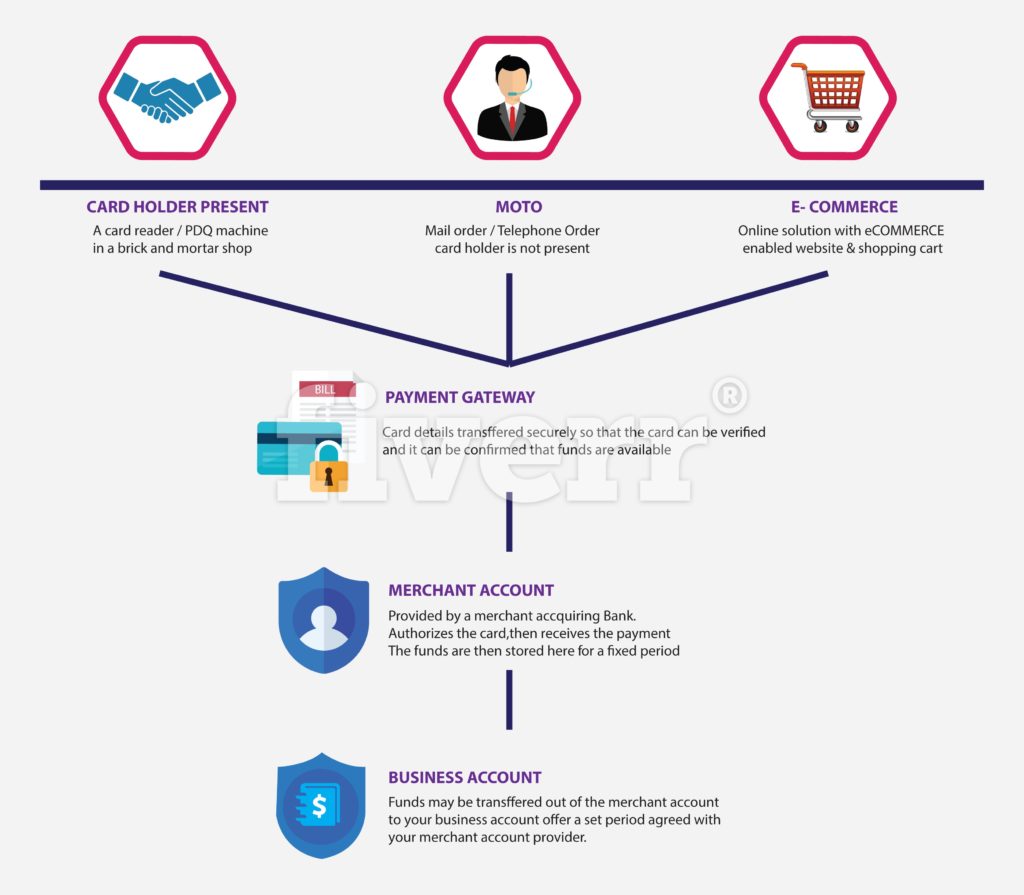

To minimize your risk and protect the company’s operations, business owners set up more than a single merchant account. Still, it is important that all merchant accounts are boarded in a single payment gateway to ensure balanced business operations. This is where merchant account load balancing comes in and makes good business sense to explore.

In addition to helping to mitigate risk and track sales volume, load balancing helps to reduce chargebacks. Merchant with high sales volume and sales transactions can benefit from load balancing by dividing their processing volume across different acquirers.

Load balancing can also offer massive benefits to your business if you own more than one product or sales website. Yes, load balancing can help you provide more accurate descriptors linked to each website and product line. This way, you’ll be better able to reduce chargebacks, cardholder confusion, and disputes. Load balancing can also protect you from the risk of chargebacks, especially associated with a breakdown in the supply chain or a failed product lunch, by ensuring the damage is limited only to the account attached to the failed product line.

If you work with multiple affiliate networks, load balancing can help. You can use it to better identify affiliates that could hurt your business and protect yourself from the potential fraud of these affiliate networks.

Benefits of Load Balancing

1) One of the key benefits of load balancing is that it allows e-commerce merchants manage multiple accounts across a single payment gateway, ensuring improved account management functions.

2) Since load balancing allows transactions to be managed via one dashboard, an e-commerce merchant only needs a single login and password, allowing for effective management and reconciliation of accounts.

3) Load balancing allows ecommerce merchants view their accounts individually or globally. This eliminates redundancy of function and improves productivity.

Closing Thoughts On Merchant Account Load Balancing

The phrase “don’t put all your eggs in one basket” comes to bare when managing an online merchant account is concerned. By spreading your transactions across different merchant account channels, you can better manage high chargeback volume occurring on a single account. You will also be better equipped to manage all accounts in a simplified manner, saving your time effort and money in the process. Diversification is the key, combined with account parameter management.

About The Author

Mark Sands, co-founder of High Risk Merchant Account LLC, an authoritative expert in the high risk merchant account space. Mark has decades of experience in the payment industry & enjoys writing on entrepreneurial related topics.