Understanding ACH Payments

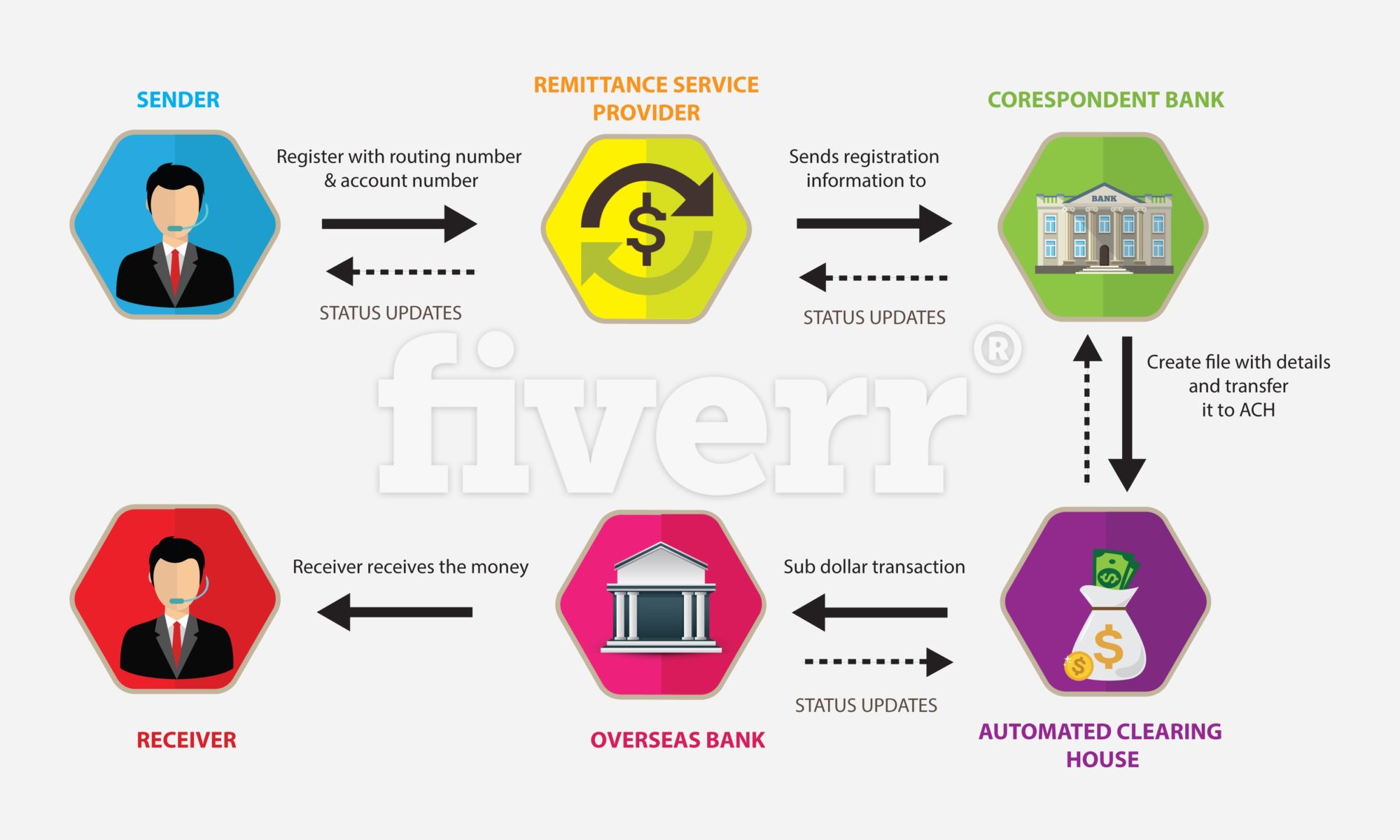

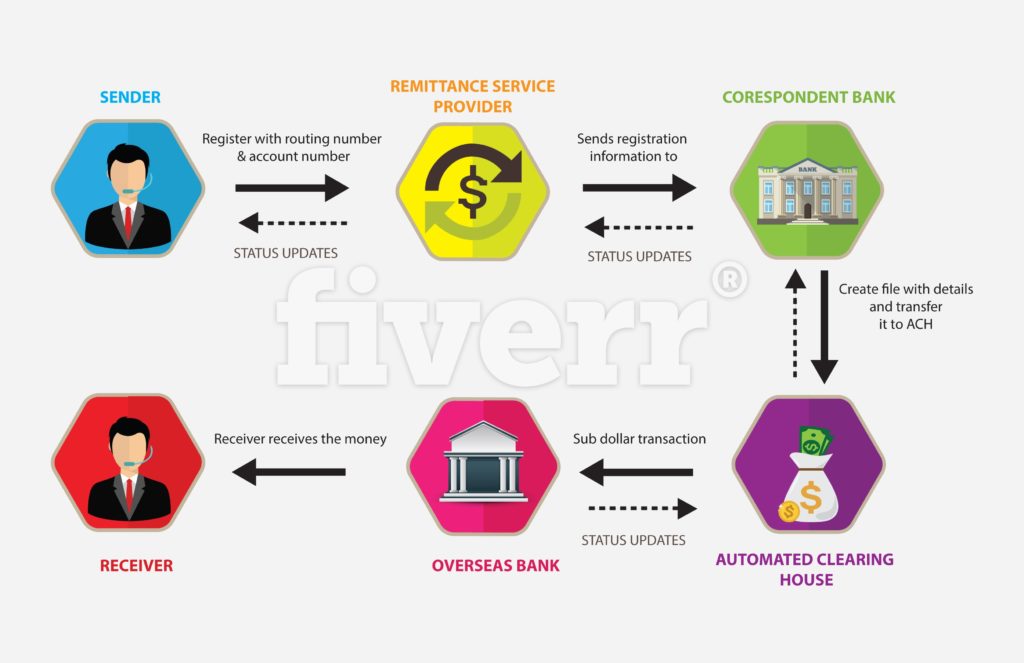

In order to perfectly understand how these kinds of payments are made, it’s essential to comprehend them entirely, as well as to know what they are for. So, what are ACH payments? It’s sounds like a foreign language, right? Don’t worry, it’ll just be like that at the beginning. ACH payments are electronic payments that are created and processed through the ACH network. ACH means “Automated Clearing House“. Whenever you are buying and or paying for something, the funds from your checking account move from one bank to another without you even noticing.

The payment processing tends to be inexpensive, as it is done by automatized computers, or as some other people would say; “robots“. These kinds of procedures are very beneficial for both consumers as well as for the companies. They are very safe as well because they have an automatic record-keeping so that everything can be easily accessible. Today everyone uses ACH payments all around the world, but the real mystery revolves around the technical jargon. This is something very important that you might not be familiar with.

ACH processing is responsible for the employer’s pay wages that go through the direct deposits. The ACH is also responsible for the bills that were paid electronically. These payments represent a huge part of the money movements, the Electronic Payments Association calculated that more than 25 billion payments were made last year only, and that is exclusively in the US. ACH is also responsible for some of these uses: the deposit of money of an employer onto the employee’s bank account. The deposit of a costumer when this one is paying a service provider. When a costumer changes banks. When a business pays a supplier for its products.

Why would you want to use it?

Most of the times, employers want you to use this method in order to achieve several things;

- The account number

- The name and entity of your bank

- The type of credit card and bank account that you are using

- The bank’s routing number

Once the employer know this information, a payment can be created and transferred to the right account in a fast and efficient manner. This method can also be used in order to make withdrawals from different accounts.

ACH payments are usually electronic from the beginning onto the end. There are some exceptions though, like checks turning into electronic payments. In this case they are being transferred through the ACH system.

What are the benefits of the ACH payments?

- They are electronic. Everything online is super easy and fast to use. It’s much cheaper because you don’t need to pay for anything. It’s easier to handle for absolutely everyone.

- Keeping track of them is really easy, and a smart thing to do. You can access the transaction history in order to keep account of your personal finances and information.

Why is this a good idea for businesses?

It’s very easy to handle. Costumers just pay and the email arrives to the company. It’s as easy as that. There is absolutely zero risk. It is extremely cheap. You don’t have to worry about paying anything at all! No plastic, no paper, no cards. Overseas payments are not a problem anymore. It’s really fast, almost immediate.

Why Is this a good idea for consumers?

The payments are very easy and fast. You don’t have to spend a lot of time and energy writing checks when there aren’t any left. You don’t get charged any extras. Everything is in autopilot, you really don’t have to make any effort.

Accepting ACH checks from your clients

You’ll going to have to count on the payment processors, without them you won’t be able to obtain any money and or checks from your business. Ask your service providers if they can actually manage the ACH payments.

- You can ask your bank.

- Go to the company that processes your credit card or past payments.

- Look for a payment processor.

- Your software provides and or other providers.

Be careful with the monthly fees. In case your business is safe, you’ll be able to obtain all of the benefits without being charged, but as the risk increases, so do the taxes. It might still be affordable in case you make a couple of transactions each month.

What are the actual costs?

The system can fit any business, it doesn’t really matter if it’s a small one or a tiny one. Obviously the bigger the business, the more transactions you’re going to have. The usual costs per transaction are 11 cents, so it is not much when you look at it from a perspective, but if you sum it up… it really does make a greater difference. The smaller the business, the higher the transaction rates tend to be, why? It’s a mystery. No, actually is to maintain our capitalistic system. If your business is very small, you can even be charged five times that amount of money per transaction. We’re not even counting what is the credit card processing going to cost after the ACH payment.

Now you might be thinking that the best option, at first. Would be to start with non-electronic payments, but that is actually even more expensive than the ACH payments.

ACH for personal use

You can actually utilize the ACH system for personal reasons. If you want to, you can receive money through this method without any problem. Obviously, they are going to charge you the established quote per transaction.

- You can make these transactions easily and in a very favorable way through several third-party apps and payment services.

- Bank offers. Some banks offer some special packages in which you can take advantage for these benefits.

Faster ACH Payments

Today this is completely possible. It all began two years ago, now the payments are starting to be faster and faster. Before that, you could only get your money within 2-3 business days without even counting weekends.

Conclusion:

ACH is replacing paper checks and becoming the norm in today’s business landscape. The perfect solution for billing customers remotely, for payments on good and services. Employers love it for payroll as it streamlines processes, reduces overhead, and is environmentally friendly. The Federal Reserve is speeding processing times and in many cases the norm is same-day clearing. If you are considering the benefits of ach processing for your business, give us a call to discuss your needs.

About The Author

Angela De Steffano

Staff writer at High Risk Merchant Account LLC

Angela is a merchant account specialist and heads the marketing team at HRMA-LLC.

PLEASE BE SOCIAL: